Thai Limited Company Registration is a multi-step process governed by precise legal requirements. Once registered, a business can apply for and receive a company corporate tax ID card from the Revenue Department, as well as register for value added tax (VAT) if required.

The first step involves reserving a name with the Department of Business Development (DBD). This name must be unique and comply with DBD’s naming regulations.

The Memorandum of Association (MOA)

A Memorandum of Association is one of the most important documents during the Thai limited company registration process. It acts as the company’s fundamental constitution, detailing its core objectives, capital structure, and internal governance procedures. A professionally drafted MOA can help protect shareholders’ interests, while also adhering to Thailand’s regulations.

The MOA begins by establishing the company’s name and registered office address, followed by a description of its business objectives and authorised capital. It must include the maximum amount that the company can raise through issuance of shares and how this sum will be divided into equity and preference shares. The MOA should also explain the company’s legal liability, stating that each company member’s liability cannot exceed the value of their shares in the company.

Any alterations to the MOA must be approved by the company’s board of directors and communicated to the Registrar of Companies. The company must also hold a general meeting to obtain the approval of shareholders for these alterations. If the alterations concern the company’s object clause, or any changes to the nature of the liabilities of its members, a special resolution must be prepared and submitted to the Registrar of Companies.

The Articles of Association (AOA)

The Articles of Association (AOA) is a document that establishes the internal management procedures of a company in accordance with Thai laws. This includes establishing operational procedures, setting up quorum numbers and voting thresholds, and defining the extent of business exercises that the company is permitted to take on.

The AOA must be filed with the Department of Business Development along with a copy of the MOA. It must include the company name that has been successfully reserved, the province where it will be located, its business objectives, the capital to be registered, and the names of the promoters. At least three promoters must sign the AOA. The promoters can be both foreign and Thai citizens.

In contrast to the Memorandum of Association, which outlines the company’s goals and authority, the AOA is more concerned with internal management rules and regulations. Changes to the AOA can be made by a special resolution passed at the annual general meeting of the company, and must be approved by the Registrar of Companies before becoming effective.

The AOA must be amended if the company’s business activities change. It should also be amended if it wishes to change its name, or if it wants to transfer the ownership of shares between shareholders. In addition, the list of shareholders must be filed with the Department of Business Development annually. The list must be certified by the company’s directors and authenticated by at least one director.

The Share Certificates

As a business owner, you will need to follow strict accounting procedures in accordance with the Civil and Commercial Code and Revenue Code. This includes the preparation of a set of accounts and an annual financial statement, certified by the auditor. This is a critical document that will help to ensure the company has sufficient assets and is not over-borrowed.

At the time of establishing a limited liability company, you will need to deposit a fixed amount of share capital in a bank account to be used for the company’s operation. The number of shares deposited and whether they are ordinary or preference shares can be changed only by an amendment to the memorandum of association or in another method authorized by the law.

A private limited company is Thailand’s most popular business structure and suits businesses that have scale, high income or value and require systematic management. It is managed by a board of directors and liabilities are limited to the par value of the shares held by shareholders.

To register a private limited company, the company promoters must be natural persons over twenty years of age and must be available to sign documentation during the registration process. A statutory meeting is convened to make all the appointments including those for directors, officers and auditors. Once the appointments have been made, a bank certificate must be presented and an application submitted to the Department of Business Development.

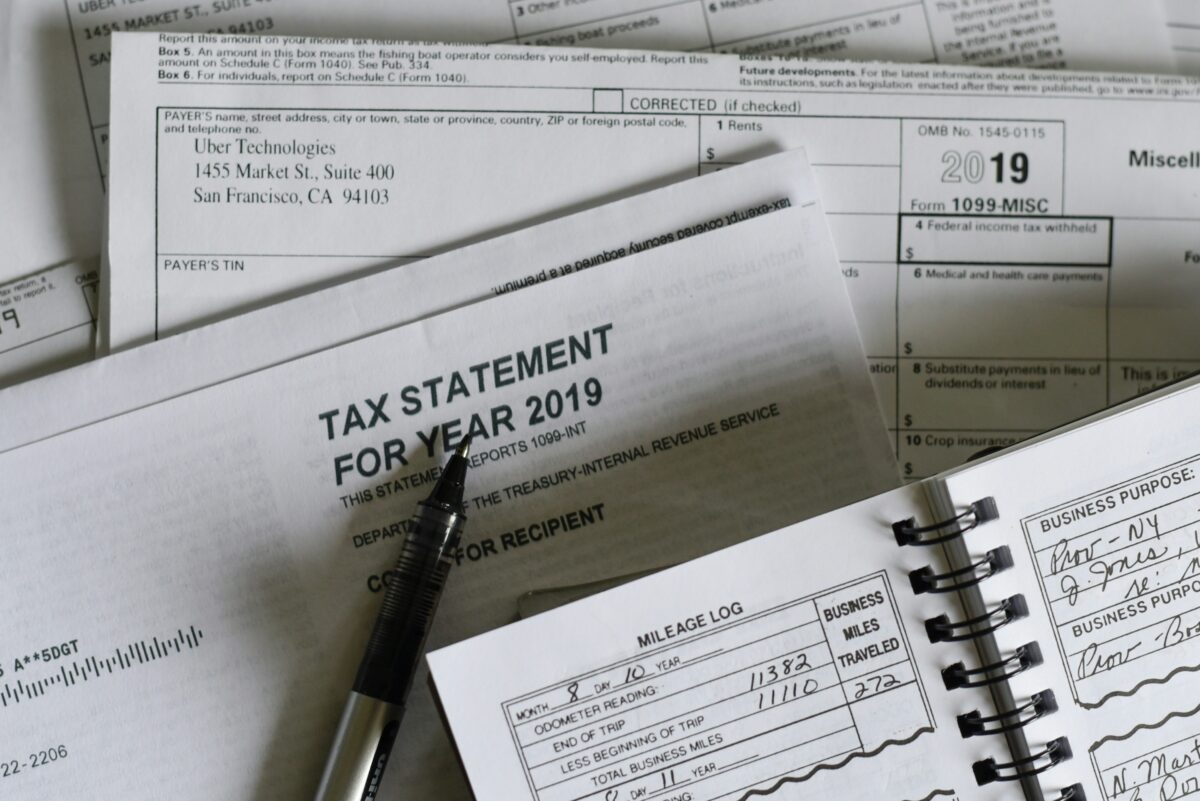

The Tax Identification Number (TIN)

A TIN is an alphanumeric code that identifies your business in the Thai tax system. Your TIN is assigned once your company is registered by the Department of Business Development. It will also be your tax ID number when you register for Value Added Tax (VAT).

All Thai companies must acquire and display their TIN in public places. This is to ensure that third parties, including investors and lenders, have a clear picture of the company’s financial state. Failing to obtain a TIN may result in legal penalties, especially when it comes to reporting foreign income. It can also complicate matters such as opening a bank account and securing loans.

As a result, the TIN registration process can be lengthy and complicated. It is important to work with an experienced team to avoid delays. Professional assistance can also minimize the risk of mistakes, as Thailand has strict regulations regarding the validity and legality of documents submitted for TIN registration.

In addition to establishing the legal structure of your company, a TIN allows you to secure a work permit and visa for your foreign employees. This, in turn, can expedite the hiring process while also enhancing your company’s credibility and reputation for legal compliance and professionalism. For overseas investors, a TIN can help to limit liability and protect their personal assets from the risks of operating in Thailand.